Since the beginning of the XXᵉ century, the art market has gone through periods of prosperity and profound upheaval, influenced by economic crises, wars and technological change.

Decade after decade, the sector has adapted, passing through phases of decline and then rebound, offering valuable lessons for understanding its resilience. Art Shortlist decided to investigate how the art market has fared through crises and decades.

The 1900s: the rise of modern art

At the beginning of the 20th century, the art market was mainly based on European galleries.

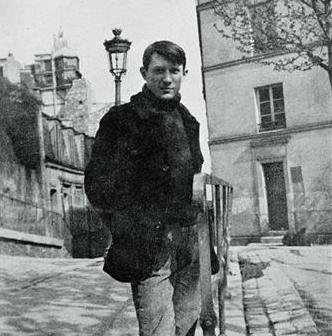

Paris is a major artistic center, attracting artists such as Pablo Picasso, Henri Matisse and Amedeo Modigliani.

Pablo Picasso in Paris in 1904

During this period, a craze for the avant-gardes developed, and interest in modern art intensified, although academic works continued to dominate the market. The relative economic stability of the time supported galleries and encouraged collectors to buy art.

The 1910s: the impact of the First World War

The First World War abruptly slowed down market growth. Galleries are temporarily closed and artistic exchanges between countries are increasingly limited.

However, in the post-war period, there was a rapid recovery, especially with the rise of the Roaring Twenties, where modern art gained even more popularity.

Paris during the historic flood of 1910

New York is also beginning to develop as a new pole of the world art market, in parallel with that of Paris. It is important to note that at that time American collectors mainly supported European artists.

The 1920s: the golden age of modern art and the Roaring Twenties

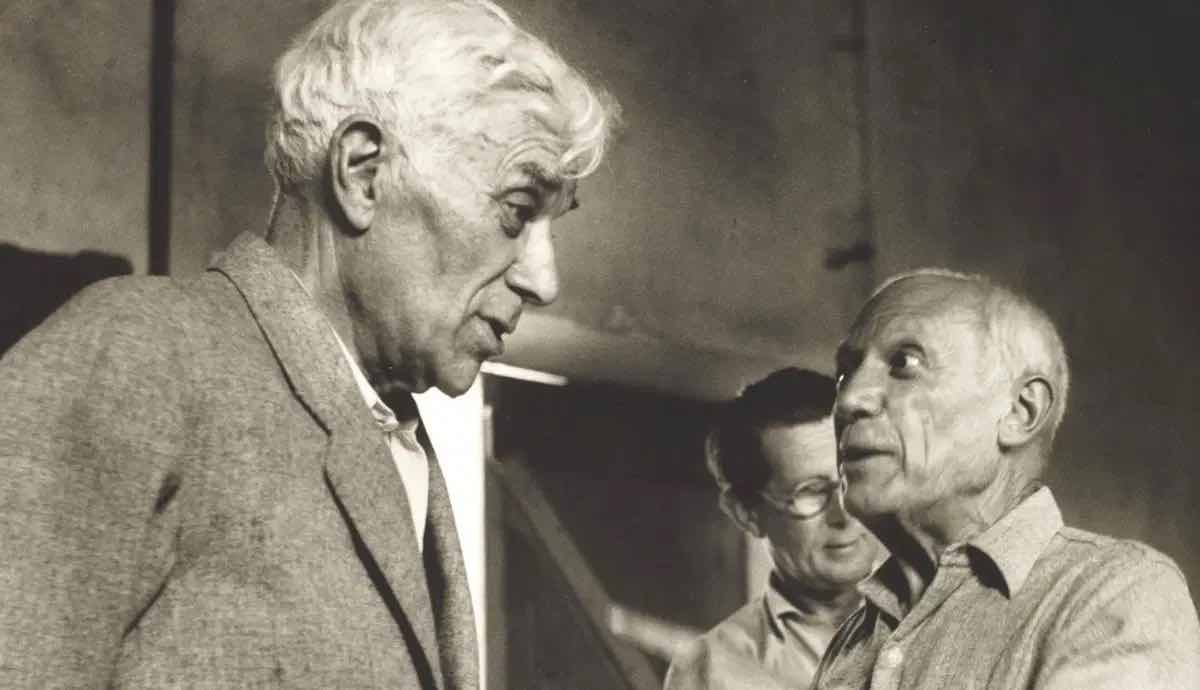

The Roaring Twenties were marked by a strong demand for modern artists such as Picasso, Braque and Delaunay. The stock market is soaring and the art market is benefiting from this economic prosperity.

Pablo Picasso and Georges Braque

Galleries and auctions in Paris and New York attract an international audience. However, this period of growth suddenly ended with the crash of 1929, which precipitated the art market into a decade of crisis.

The 1930s: the Great Depression and the decline of the market

The crisis of 1929 led to a drastic drop in sales and prices. Works of art see their value drop by at least 50% and collectors therefore turn to historical and safer pieces, abandoning contemporary and emerging artists.

In Fourteenth Street, Reginald Marsh, 1934, Museum of Modern Art, New York

In Paris, art sales fell by more than 60% in just a few years. Despite this marked, even unprecedented decline, some buyers are showing resilience by continuing to invest in works perceived as having sustainable value and long-term appreciation potential. This nucleus of buyers helps to maintain a selective demand for the most popular pieces, especially those associated with avant-garde artistic movements or established artists of the past.

The 1940s: the Second World War and its consequences

During the Second World War, the art market was strongly impacted, in particular because of the major looting orchestrated by the Nazis, who appropriated thousands of works from private collections, often those of Jewish families.

This massive dispossession, combined with the closure of galleries and many cultural institutions, dealts a severe blow to the European art scene. At the same time, many artists, critics, and art dealers fled Europe to take refuge in the United States, where they contributed to the emergence of a new arts center in New York, thus gradually diverting attention from the international market to this city.

German soldiers of the Hermann Göring Division posing in front of the Palazzo Venezia in Rome on January 4, 1944 with a painting by Giovanni Paolo Pannini

After the war, the art market began a restart phase with initiatives to restore the artistic heritage and revive interest in European art. Auctions resume and exhibitions are organized in cultural capitals to reconnect the public with the works of European masters.

This period of reconstruction also benefits from the support of collectors and institutions wishing to restore the cultural vitality of Europe, while responding to a growing demand for modern and contemporary art that emerged during the conflict.

The 1950s: the emergence of New York and contemporary art

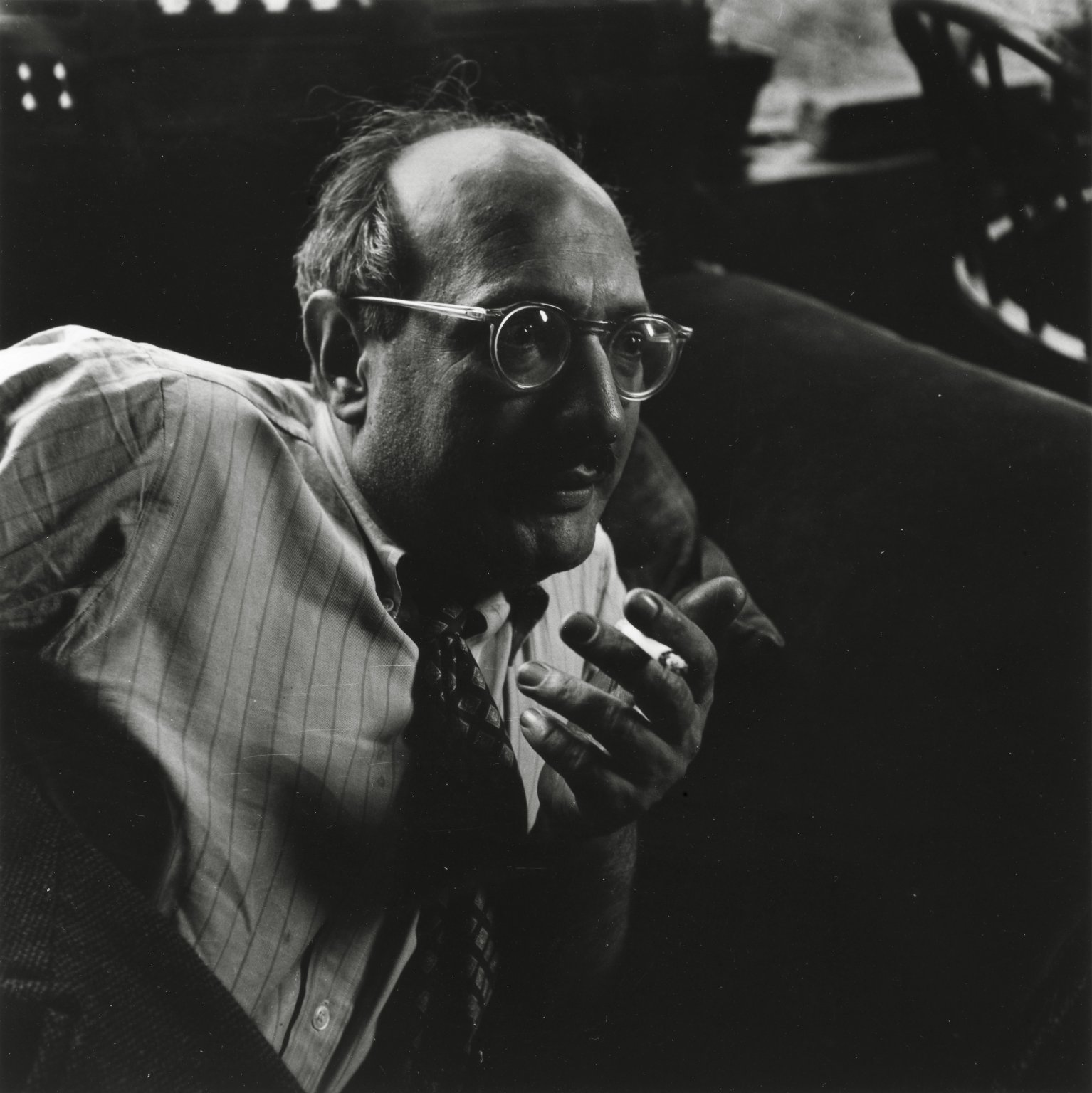

After the war, New York established itself as a major center of the art market, with artists such as Jackson Pollock and Mark Rothko.

Mark Rothko in 1949

This period marked the rise of abstract expressionism, attracting new collectors, mainly Americans. The market is diversifying and opening up to contemporary works, marking a turning point in relation to Europe, which is more attached to classical artists.

The 1960s: the rise of pop culture and art as an investment

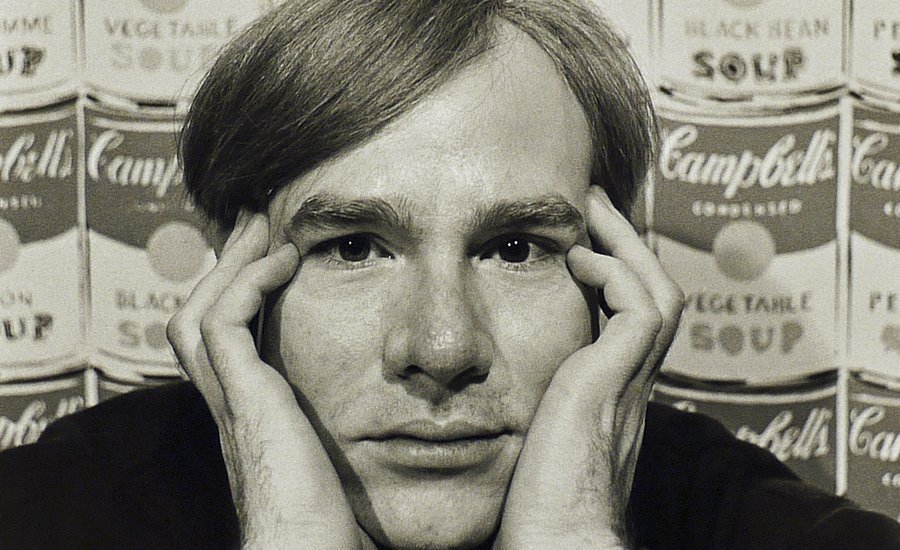

The decade of the 1960s was marked by pop art with Andy Warhol and Roy Lichtenstein. Art becomes more accessible and attracts a new generation of collectors.

Andy Warhol in 1962

The art market is experiencing some stability, but prices are increasing for contemporary works, reinforcing the idea of art as an investment.

The 1970s: the oil crisis and investment diversification

The 1973 oil crisis created an inflation that affected the art market, but also encouraged investors to diversify their portfolios by including works of art.

A panel in Oregon during the first oil shock in 1973

Despite the recession, contemporary art continues to attract buyers, especially the works of artists based in the United States. Contemporary art sales remain at a good level, especially thanks to an international clientele.

The 1980s: the market explosion and the speculative bubble

The 1980s were a great time for the art market, stimulated by speculation. Japanese buyers are investing heavily, especially in works by impressionists and post-impressionists.

July 20, 1987 - Vincent van Gogh's sunflowers presented upon his arrival at the Yasuda Fire and Marine Insurance headquarters in Tokyo

Prices reach records for artists like Van Gogh and Picasso. However, this speculative bubble burst in 1991, leading to a significant market correction.

The 1990s: the return to stability and the rise of new markets

After the bursting of the speculative bubble in the late 1980s, the art market was undergoing a period of stabilization. After 1990, auction houses and galleries refocused on quality pieces and avoided speculative excesses.

This period was marked by the emergence of new buyers in Asia, especially in Hong Kong, which established itself as a new regional center of art. In addition, the 1990s saw the beginning of increased internationalization with a growing interest in contemporary artists and the works of young artists.

The 2000s: globalization and the first financial crisis

The 2000s marked the era of globalization of the art market, with an intensification of trade between the West and the Asian and Middle Eastern markets. Contemporary art is experiencing an unprecedented boom, with artists like Damien Hirst and Jeff Koons reaching records at auction.

Damien Hirst and his agent Frank Dunphy in 2008

However, the 2008 financial crisis caused a sharp drop in sales, with a 28% drop in auction sales in 2009. Despite this crisis, collectors continue to buy and the market begins to rebound in 2010.

The 2010s: the recovery and arrival of online markets

The 2010 decade saw a gradual recovery after the financial crisis and the art market regained some stability. Prices are rising again, especially for works by contemporary artists. Collectors from China, India, and other emerging markets play an important role in the growth of the sector.

The arrival of digital solutions has disrupted the art market

It is also during this period that online sales platforms are emerging as effective solutions, opening the art market to a new international audience. Large auction houses, such as Christie's and Sotheby's, invest in online sales to reach a wider clientele.

The 2020s: the pandemic, digital and new purchasing behaviors

The COVID-19 pandemic marks a major turning point for the art market in 2020. With the closure of galleries and the cancellation of fairs, the sector is turning massively to digital.

Online sales are exploding, with a 50% increase in 2020 compared to 2019. Sales records are reached in fully digital auctions. Collectors are adapting their behaviors and the market continues to evolve in the face of uncertainties and upheavals.

Conclusion: The resilience and adaptability of the art market

Through each decade, the art market has been able to reinvent itself in the face of crises. The great periods of decline, recovery and innovation show a remarkable resilience that is based on an ability to adapt to economic and technological changes.

Today, with the rise of online sales and growing interest in emerging markets, the art sector is at a new crossroads, promising fascinating developments for the years to come.